HOW TO CAPITALISE ON DISRUPTION

Business disruption is unpredictable in one sense, but in another we know it's coming. We just don't know exactly what it will look like and how its characteristics will undermine the business models that have brought about the success that firms have enjoyed until now.

Incumbent firms face not only threats from start-ups with new business models, but also from formidable firms in previously unrelated sectors. As a result, disruption has earned a reputation of negativity, and as with risk management in general, people tend to focus far more on the negative threats than the positive opportunities on offer.

Since long before the digital economy, the best leaders have orchestrated success by intuitively balancing risks and opportunities. But digital disruption has introduced an element of risk and opportunity that many leaders have little if any experience of dealing with. It's when new business models evolve from the innovative integration of digital technologies – that enable customers to achieve their outcomes in much better ways.

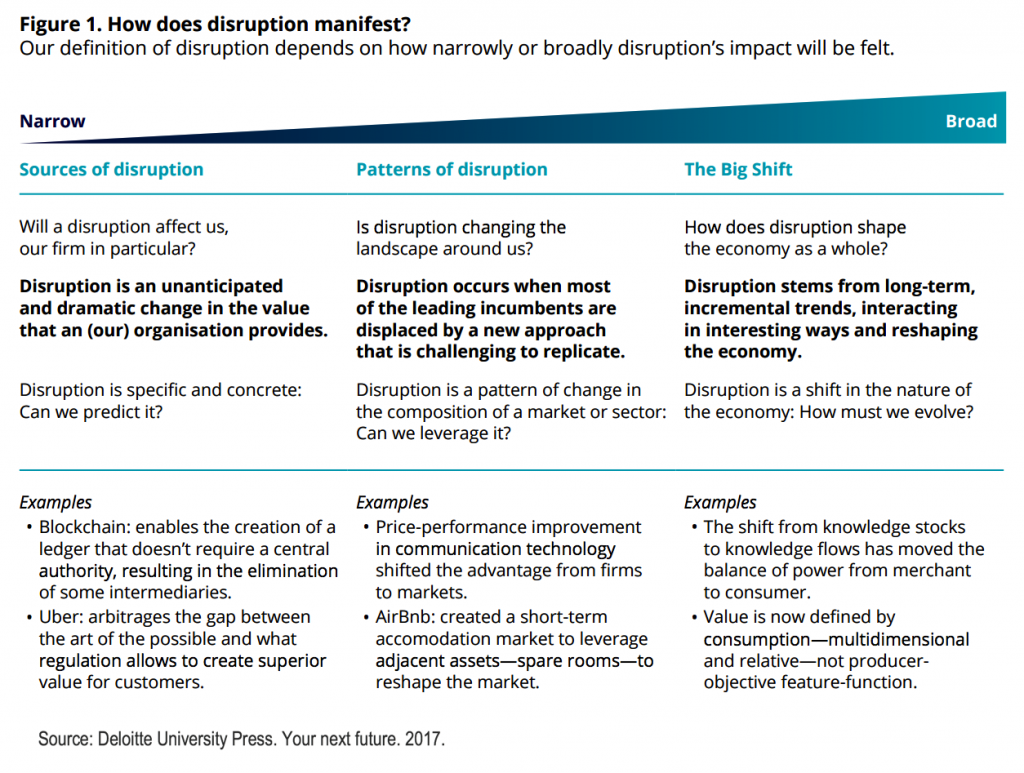

In The Upside of Disruption EY suggested that three primary forces – technology, globalisation, and demographic change – are driving the current wave of disruption. Meanwhile, Deloitte's view on how disruption manifests is illustrated below.

Read the full article in which the above illustration appears: Your next future

The Dark Side of Disruption

There's a tendency for established firms to focus on the negative side of disruption. Their traditional business models and operational excellence which got them to where they are today are now under fire in a way that most aren't accustomed to.

While each firm is unique, it's been common for many to only respond to the digital economy threats that have begun to erode their market share. This results in their strategic response being defensive, with a focus on mitigating against risk and minimising the threats they face.

Meanwhile, as with traditional enterprise risk management, the positive side of disruption – the opportunities – are ignored. Often because leaders are so caught-up with executing their defensive strategy that they have little if any resources left to invest in offensive proactive responses, which exploit the opportunities disruption creates.

With pressure increasing from shareholders, about diminishing market share and profits, many continue to invest all their resources into defending their corner as best they can. And unless they also invest sufficiently in their strategic offensive, they are at risk of spending all their time on the back foot, aiming for short-term recovery. But that kind of balancing act will be short-lived – and then what?

Performance pressures are mounting on CEOs. Some explain to shareholders; “we couldn't respond to what we couldn't see coming”. So they stand like rabbits in headlights – knowing something's coming but not responding well. They're finding it more difficult to make money as their traditional business lose their appeal.

But it doesn't have to be that way, and the first step calls for a shift in leadership mindset to identify what drives disruptive change, together with how, when and where it might happen. Leaders need to up their emphasis on competitive intelligence to uncover what's really behind new competitive threats, what the long-term opportunities are, and what type of transformation they need to orchestrate and how, in order to exploit these opportunities.

While these leaders are delaying their response to the new economy their firms are now part of, there are others that still believe disruption is not relevant to them. “We're different, special, and well established” – are their naive words of denial.

Avoiding The Short Term

CEOs and CFOs tend to focus heavily on quarterly or annual reports, to hit the numbers that their boards are expecting and optimise their own compensation. But this doesn't help firms capitalise on disruption. This short term approach is short-sighted too, and a situation where savvy Board members need to identify and ask questions such as:

- How are we responding to digital business models?

- How might business models from other sectors hurt us?

- How will our top initiatives create competitive advantage that will scale?

- How is innovation and technology influencing our strategic planning process?

- What is the cost of only executing a defensive response?

- What opportunities exist for us in other industries?

As Uschi Schreiber of EY wrote in The Upside of Disruption:

“Due to the accelerated pace of change, plans of today might be obsolete tomorrow, and thus learning how to ask the better questions can create or lead to the right thinking.”

Capitalising of Disruption

Responding to disruption has become a core concern for firms everywhere. Some incumbents have begun to embrace and exploit disruption, so the perception of disruption is gradually shifting from threat-only to threat plus opportunity. But many are still investing their best resources into reactionary defensive initiatives that often focus on marketing and making small changes to their old products and services.

In the way that good leaders have always looked for clear opportunities when faced with unusually high risk, the best digital economy leaders are doing this in the face of disruption. The challenge for many is that they are less well equipped to do this now because they are typically new to innovation, digitisation and transformation. And as many have been swept up by commercial marketing hype, a proportion of them have become victims to The Digital Illusion.

Where, when and how disruption might happen, combined with what forces drive industry change and enterprise transformation, goes hand in hand with this new way of thinking. To make the most of opportunities, leaders and their teams must know how to transform at speed and make the right strategic choices along the journey.

Companies looking to disrupt their business models need to begin a process of rigorous self-interrogation. Discovering the upside of disruption requires both learning from those who do it well and being aware of the constraints that companies face when formulating their responses.

McKinsey suggests that by subjecting the sources of disruption to systematic analysis solidly based on the fundamentals of supply and demand, executives can better understand the threats they confront in the digital space—and search more proactively for their own opportunities. This 2-pager from McKinsey will help you consider how vulnerable your firm is to digital disruption – and what you can do before being disrupted.

Underlying Digital Economy Shift

In days gone by, firms were usually in the driving seat. Wielding their commercial advantage of knowing far more than customers did, and taking full advantage of this powerful position, with no shame about their arrogance. While those good ol' days have gone, some old-style leaders are having a tough time coming to terms with the underlying shift in the digital economy. A shift of power from companies to customers. A shift of closely guarded secrets to unprecedented transparency. A shift of customers having to deal with local suppliers to their ability to pick and choose any company, anywhere, and to deal with them directly, without the need for a middleman. In fact local merchants and other middlemen have now been replaced by platforms such as Amazon, Uber and iTunes, which empower buyers and sellers to do business directly with one another.

Not so long ago the world needed commercial or government institutions to facilitate movements and events, but the connectivity that digital has given birth to has erased our reliance on these monolithic institutions. Because now – with the right purpose – a single unrecognised, unqualified and unfunded individual can facilitate these movements and events themselves.

This is not a disruption that one company has brought about. This is a fundamental disruption that technology and network effects have introduced to the way business is won and done, and how life is lived in the fourth industrial revolution.

The Deloitte Centre for the Edge has taken a much closer look at this underlying shift and developed The Shift Index. The Shift Index is their attempt to quantify and make sense of the changes taking place in the world around us, primarily through the lens of business. The goal of the Shift Index is to help executives understand and take advantage of the long-term forces of change that are shaping the underlying economy. It tracks 25 metrics across more than 45 years, providing a comprehensive view of underlying forces not captured by short-term economic indicators.

The Shift Index metrics are divided into three indices that measure the waves of change in what The Centre for the Edge call “the Big Shift” in the global business environment:

The Foundation index measures changes that are fundamental to the business landscape, including advances in digital technology performance, rates of infrastructure penetration, and trends toward liberalisation in public policies.

The Flow index measures key performance drivers— flows of knowledge, capital, and talent—unleashed by the forces measured in the Foundation Index, along with the amplifiers of these flows. Flow metrics tend to lag Foundation metrics because of the time required to understand and develop new practices consistent with advances in the foundation.

The Impact index demonstrates the consequences of the Big Shift, so it's a lagging indicator. It captures the effects that long-term trends have on competition, volatility, and performance across industries. Impact metrics will change as firms begin to figure out how to participate in and harness the knowledge, capital, and talent flows across institutional and geographic boundaries.

The Centre for the Edge explains that the long-term trends across Foundations, Flows and Impact have have been building for decades, yet they don't affect all industries or regions equally or at the same time.

2016 Shift Index Findings

Overall, while many of the trends have remained stable, the study indicated cumulative effects of technological advances and demographic changes, and specifically the chase to harness the massive amounts of data available today, have led to increased stress and anxiety amongst companies and workers. The exponential curve gets steeper when you consider the convergence of multiple exponentially advancing building blocks in computing, storage and bandwidth into technologies like cloud computing, biosynthesis and 3D printing.

Below is a selection of findings from the 2016 Shift Index

- Although we live in a time of unprecedented new technological possibilities, and worker productivity continues to increase, firms find it difficult to take advantage of these possibilities.

- The performance of both the top quartile of firms and the bottom quartile continues to decline, but the bottom quartile is very much worse.

- The “topple rate” of leading firms continues to accelerate.

- Worker passion remains low at just 13% of the workforce.

- Overall, firms have made no perceptible progress in learning how to deal with the challenges that were clearly depicted by the Shift Index back in 2011.

- The world is changing faster than firms.

Center for the Edge Chairman John Hagel said;

“The Big Shift will ultimately require large-scale organisational transformation. Our research suggests that given the powerful immune systems of large institutions, one of the most promising ways to embark on this journey is by ‘scaling an edge,' and identifying two to three short-term initiatives that can accelerate their progress toward that opportunity, rather than taking a top-down, big bang approach to transformation.”

Some firms such as Amazon, Apple, and Salesforce have already exploited the Big Shift for their own competitive advantage. But this shift is there for any firm to take advantage of, providing their leaders are armed with the right mindset and questions.

Download the 40-page Shift Index report from Deloitte University Press.